Tax Court Vs Irs Method

Here are some of the images for Tax Court Vs Irs Method that we found in our website database.

IRS Method vs Tax Court Method Choose the Right Path

Supreme Court of Florida The Case of Brayshaw #39 s vs Agency of

Please use TAX COURT METHOD not Irs method Chegg com

State Tax Liens vs IRS Tax Liens: What s the Difference? Optima Tax

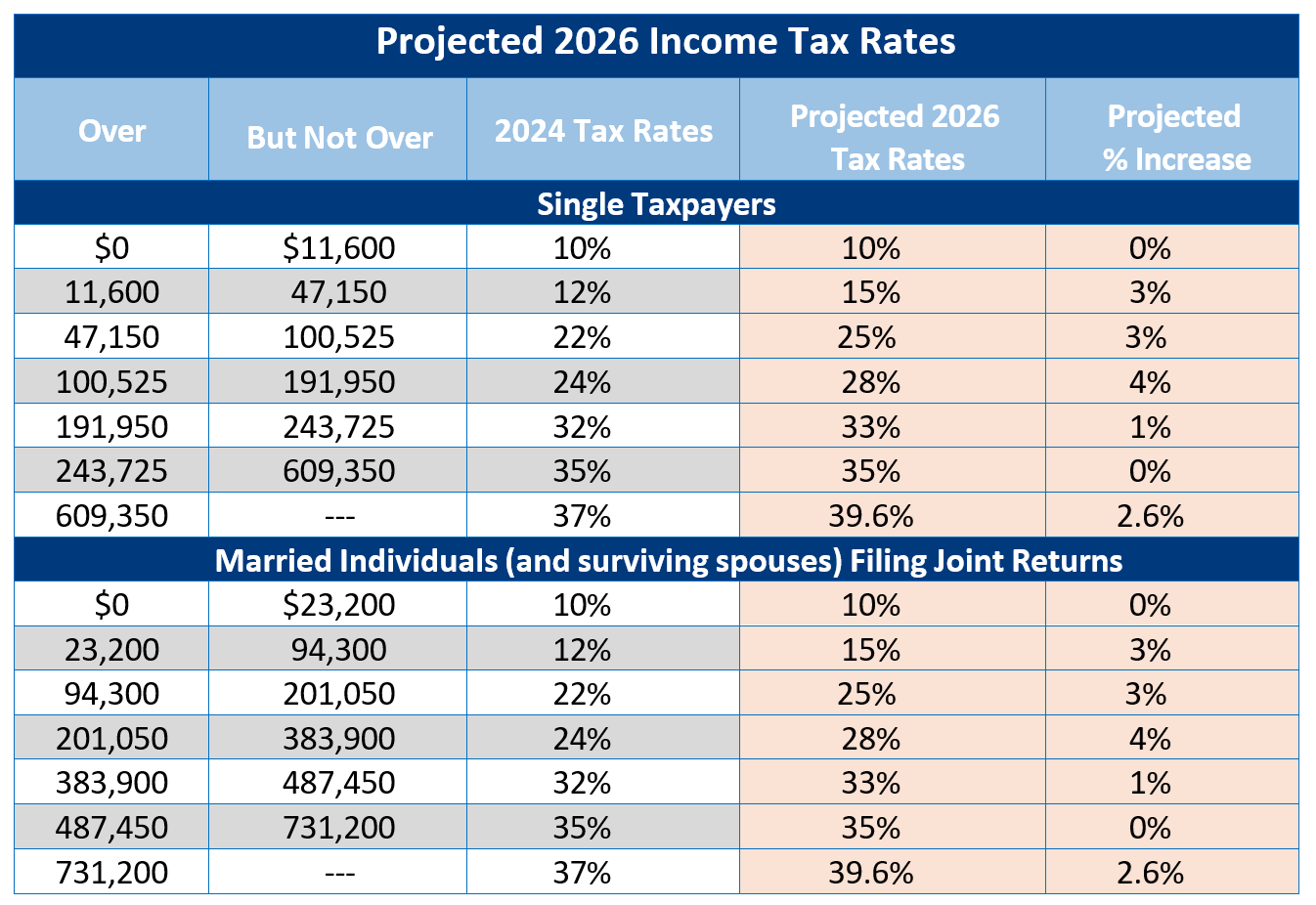

Irs Tax Brackets 2024 Vs 2025

Irs 2026 Tax Brackets Vs 2025

Amazon vs IRS PDF Business Accounting Finance Business

IRS Introduces Free Tax Filing Method for Select States

Pennsylvania State vs IRS Tax Debt Guide

Court Clarifies Tax Treatment of Loyalty Programs Houston Tax

Written by Diane Kennedy CPA on June 19 2023

Tax Court Invalidates IRS Assessment Authority for Penalties For

Tax refund method : r/IRS

Form 3115: Simplified Overview On Changing Accounting Methods

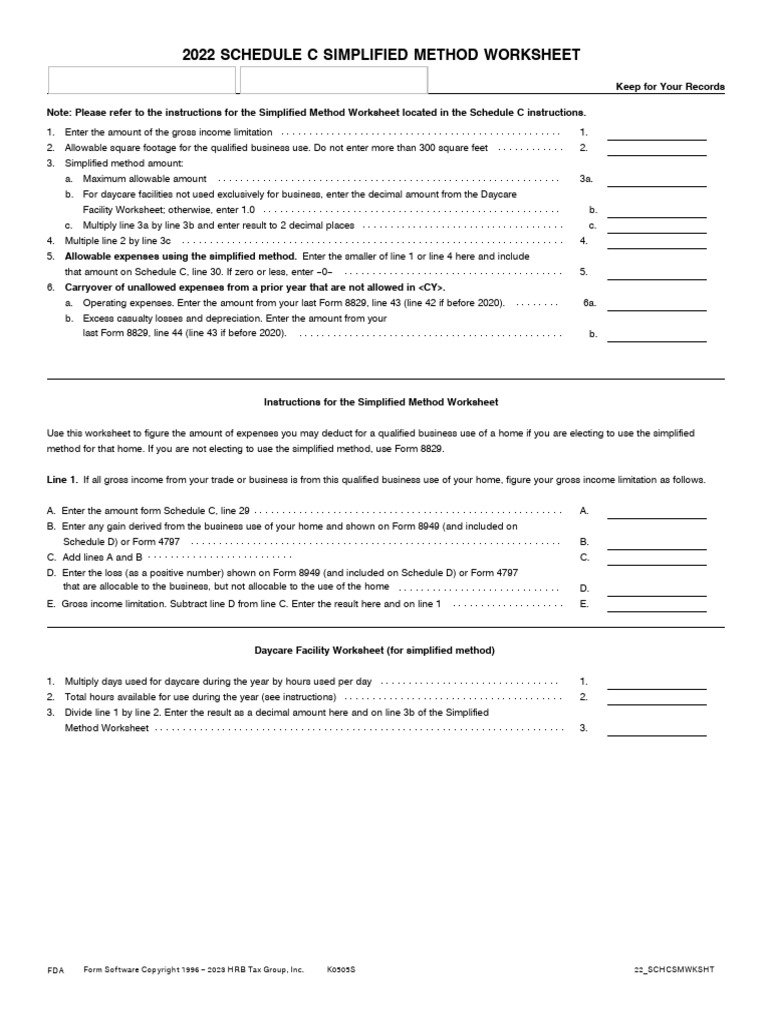

2022 Schedule C Simplified Method Worksheet fillable PDF Irs Tax

Tax Attorney vs CPA vs IRS EA: Why Not Hire a Three In One? St

Irs 2026 Tax Tables Married Filing Jointly Vs Single

Tax Court Explained: When How to Dispute IRS Decisions

Irs Tax Forms

Tax Court Strikes Down IRS Rules on Land Conservation Deals WSJ

Tax Court Rebuts IRS Ability to Assess Penalty Following Failure to

Coca Cola Owes $6 Billion to IRS Tax Court Rules WSJ

Us Tax Court Wadaef

Unlock FREE Tax Filing: VITA vs IRS Free File vs AARP Noel

IRS Changes Notice Requirement for Listed Transactions Houston Tax

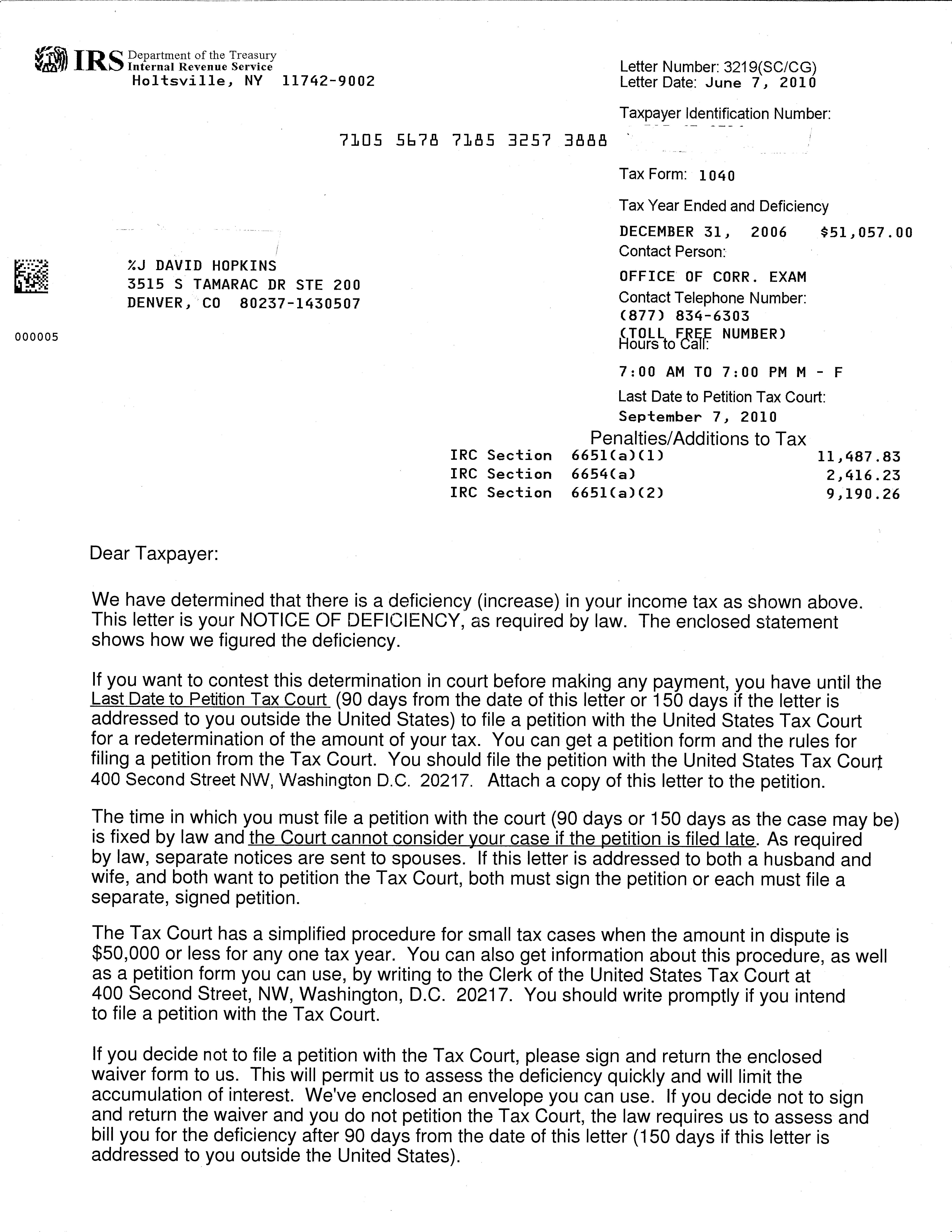

Audit Letter 3219 Tax Attorney Response to the IRS TaxHelpAudit com

IRS Hot Button: Deductible Management Fees vs Disguised Distributions

EFTPS Tax Deposit vs Federal Tax Due: With IRS Payment Method

EFTPS Tax Deposit vs Federal Tax Due: With IRS Payment Method

Supreme Court Rules 9 0 for IRS Denying Refund in Estate Tax Dispute

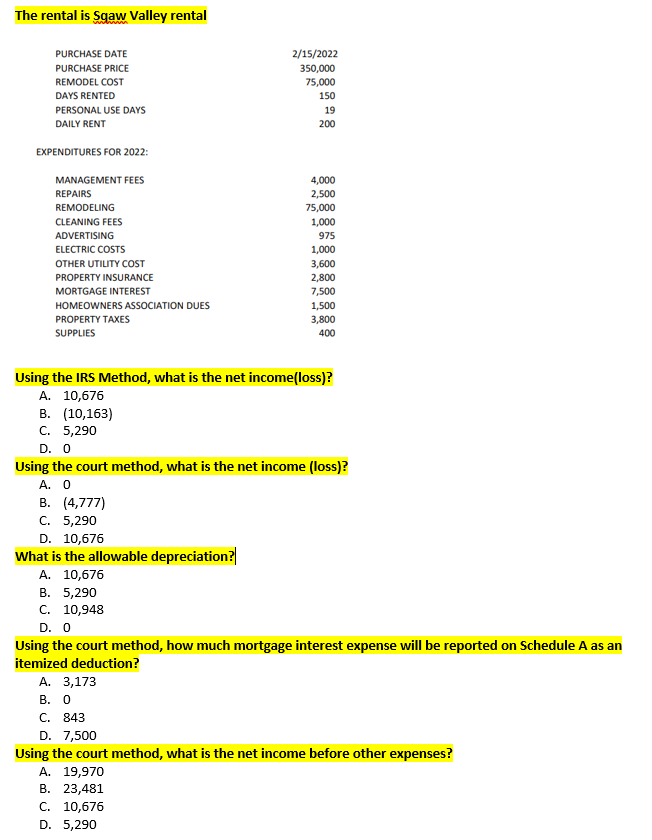

Using the IRS Method what is the net income(loss)? Chegg com

Elon Musk s X Challenges IRS in Supreme Court Battle Over User Data

ROI vs IRS Cost : r/economy

Stephanopoulos slams Scalise for CBO doubletalk on funding Israel vs

3M s Transfer Pricing Victory Puts Brakes on IRS Overreach

US court grants IRS request to probe clients of offshore finance giant

TurboTax vs IRS Transcript Does this mean my returns haven #39 t

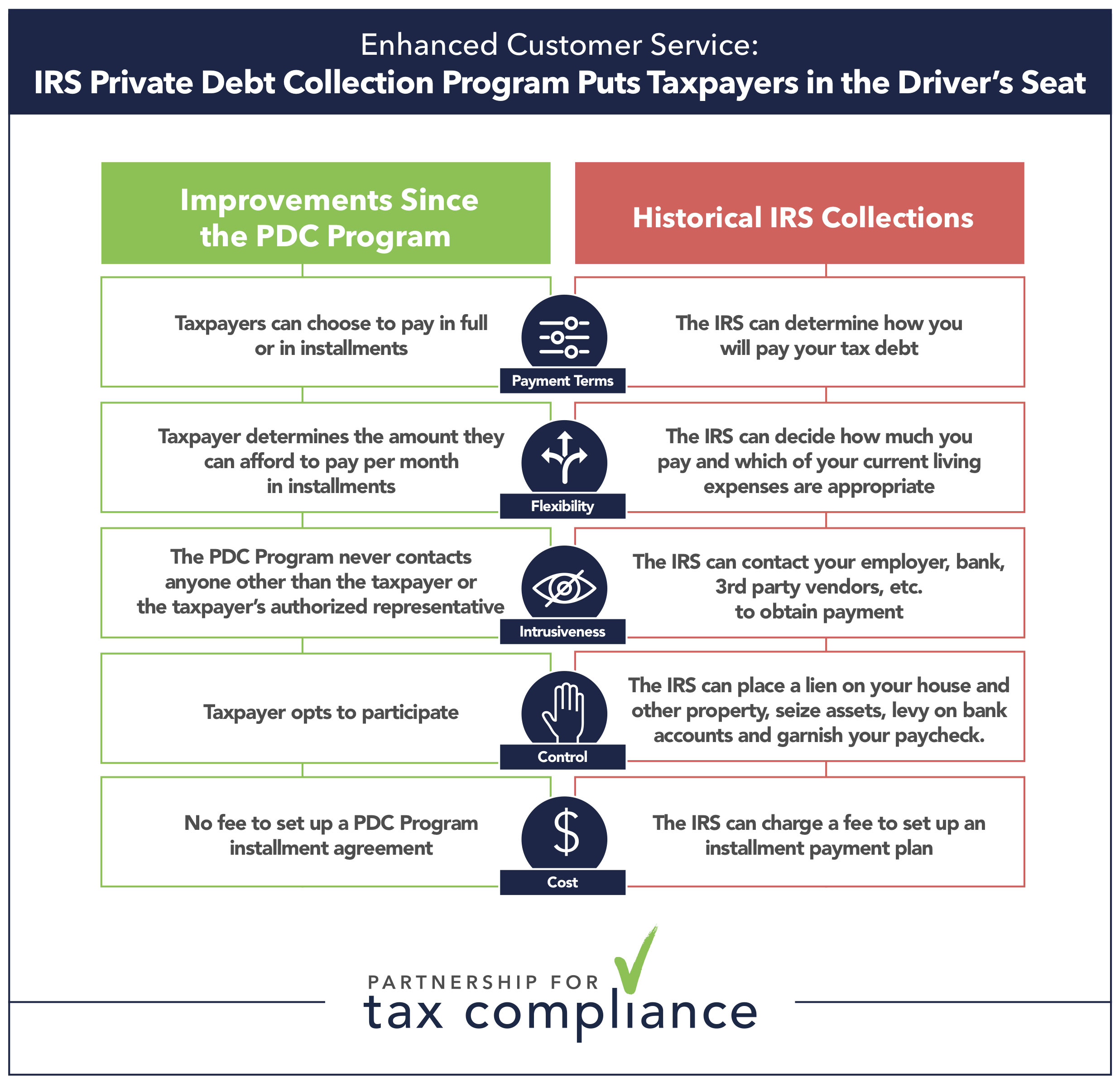

Facts Data Partnership for Tax Compliance

2023 Tax Bracket Changes PBO Advisory Group

Hedge fund billionaire drops suit vs IRS over tax leak as agency

California Estimated Tax Penalties Guide for Business Owners

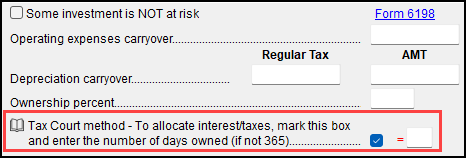

Drake Tax 1040 Schedule E Tax Court Method Election

Expenses Vs Losses: Uncover The Distinction Netzdot

2024 2025 Tax Refund Calendar

Eaton Corporation vs IRS: Transfer Pricing Dispute Prof Dr Daniel

Coca Cola vs IRS: Landmark Transfer Pricing Dispute Prof Dr Daniel

Coca Cola vs IRS: Landmark Transfer Pricing Dispute Prof Dr Daniel

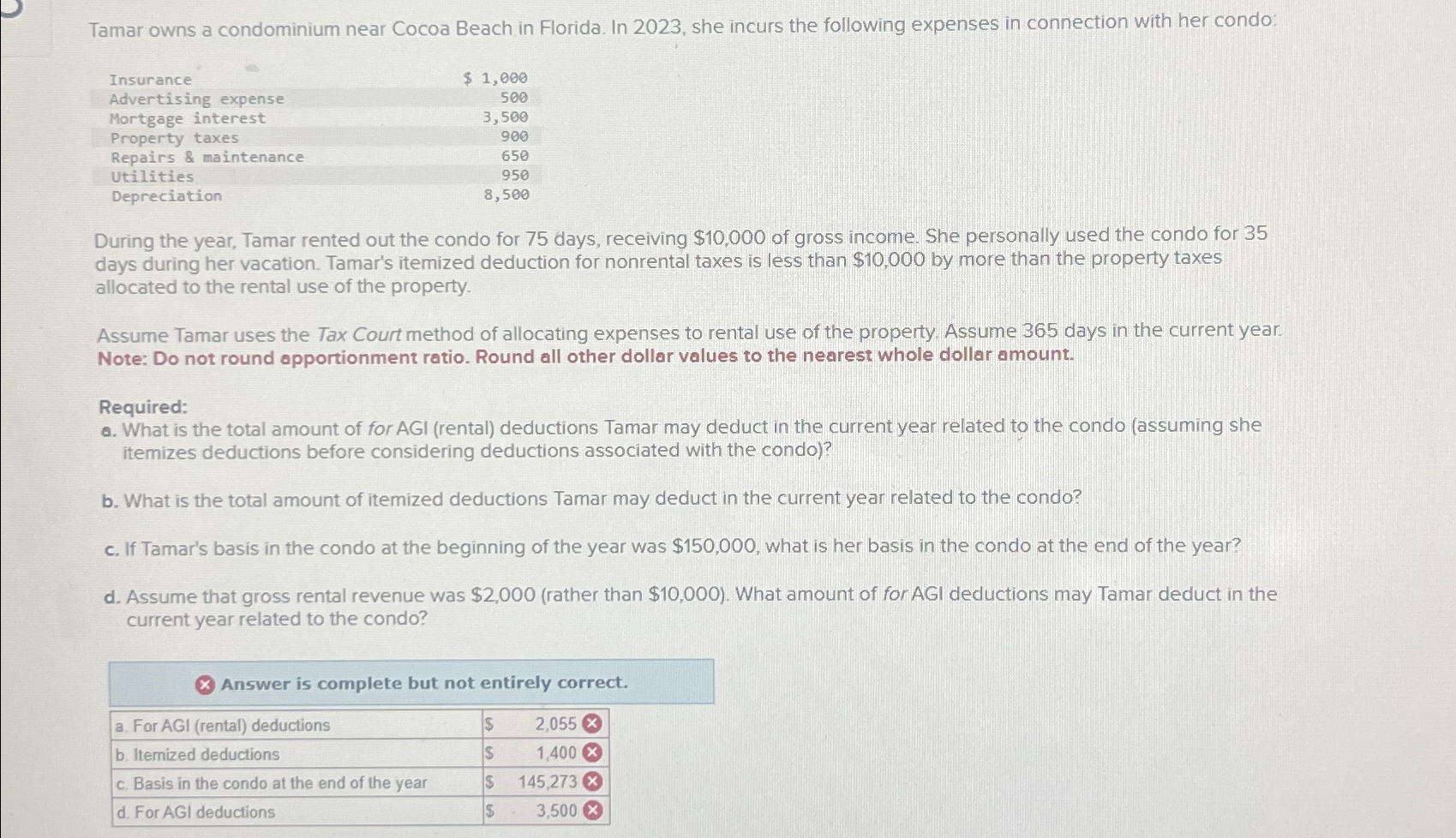

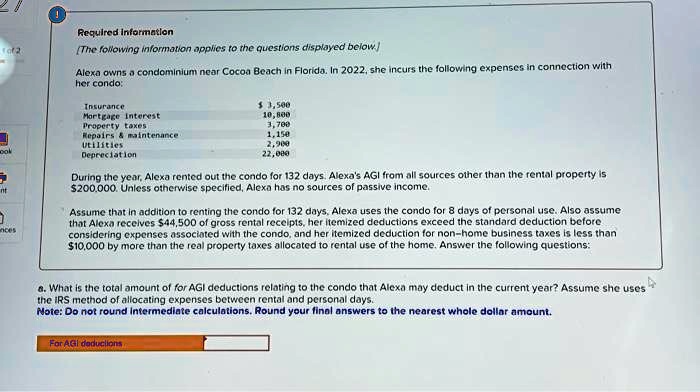

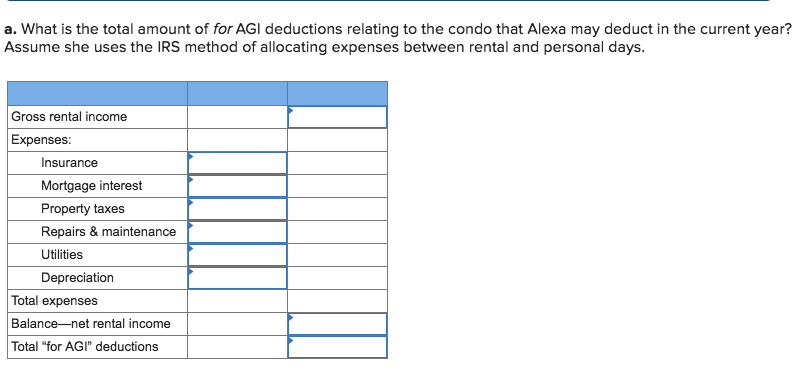

a What is the total amount of for AGI deductions relating to the condo

Bill Sheridan CAE CPT on LinkedIn: The IRS s April revision to its

Claiming Mileage With The IRS Actual Expense Method in 2026

Commodore VR/VS (IRS) with VT VZ front Standard rear SAFEBRAKE

3M Opinion: The Tax Court s Evolving View of the Administrative

1040 Schedule E Tax Court Method Election Worksheets Library

On October 30 the IRS released a Large Business and International

Solved Required informatio The following information Chegg com

Vacation home rentals and the TCJA Journal of Accountancy

FIFO LIFO HIFO Crypto Tax Guide: IRS Rules Gains and 2025 Tips

What s your FNF version of I don t care who the IRS sends I am not

A recent case from the US Supreme Court could affect you if you are a

What Are the Four Types of Innocent Spouse Relief? Tax lawyers