Section 163 J Computation Worksheet

Here are some of the images for Section 163 J Computation Worksheet that we found in our website database.

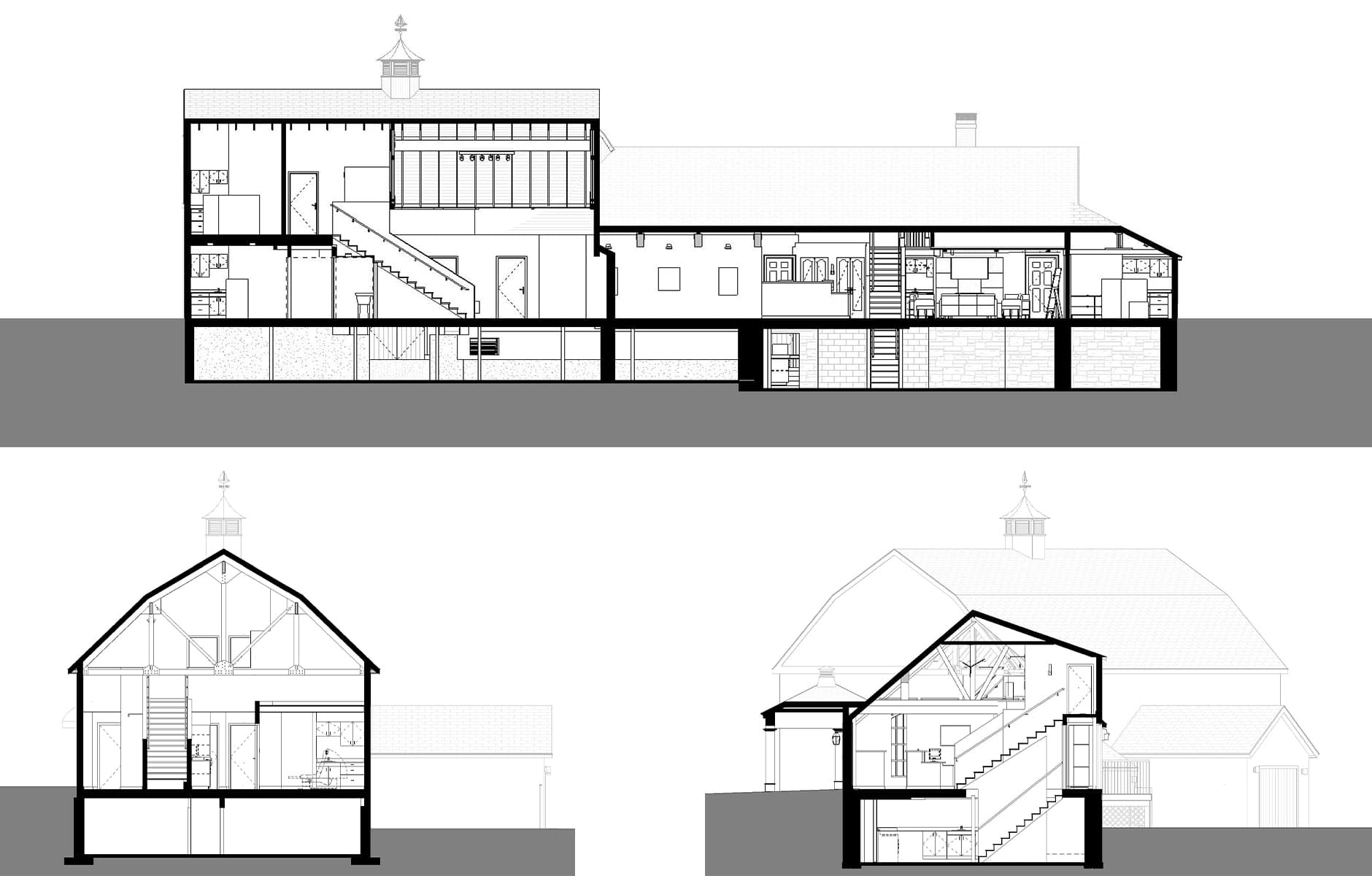

Episode 6: Creating Sections Quif Studio

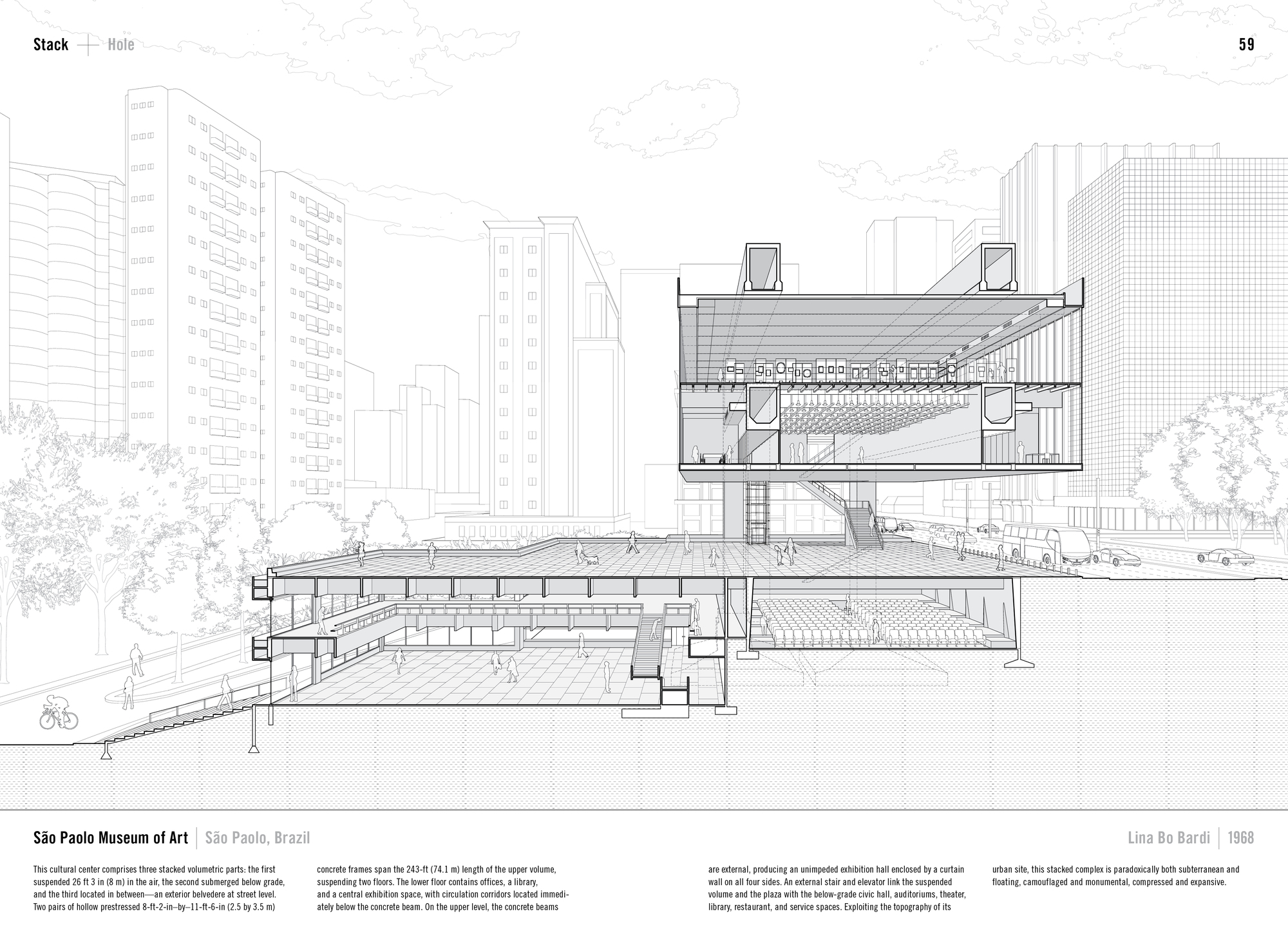

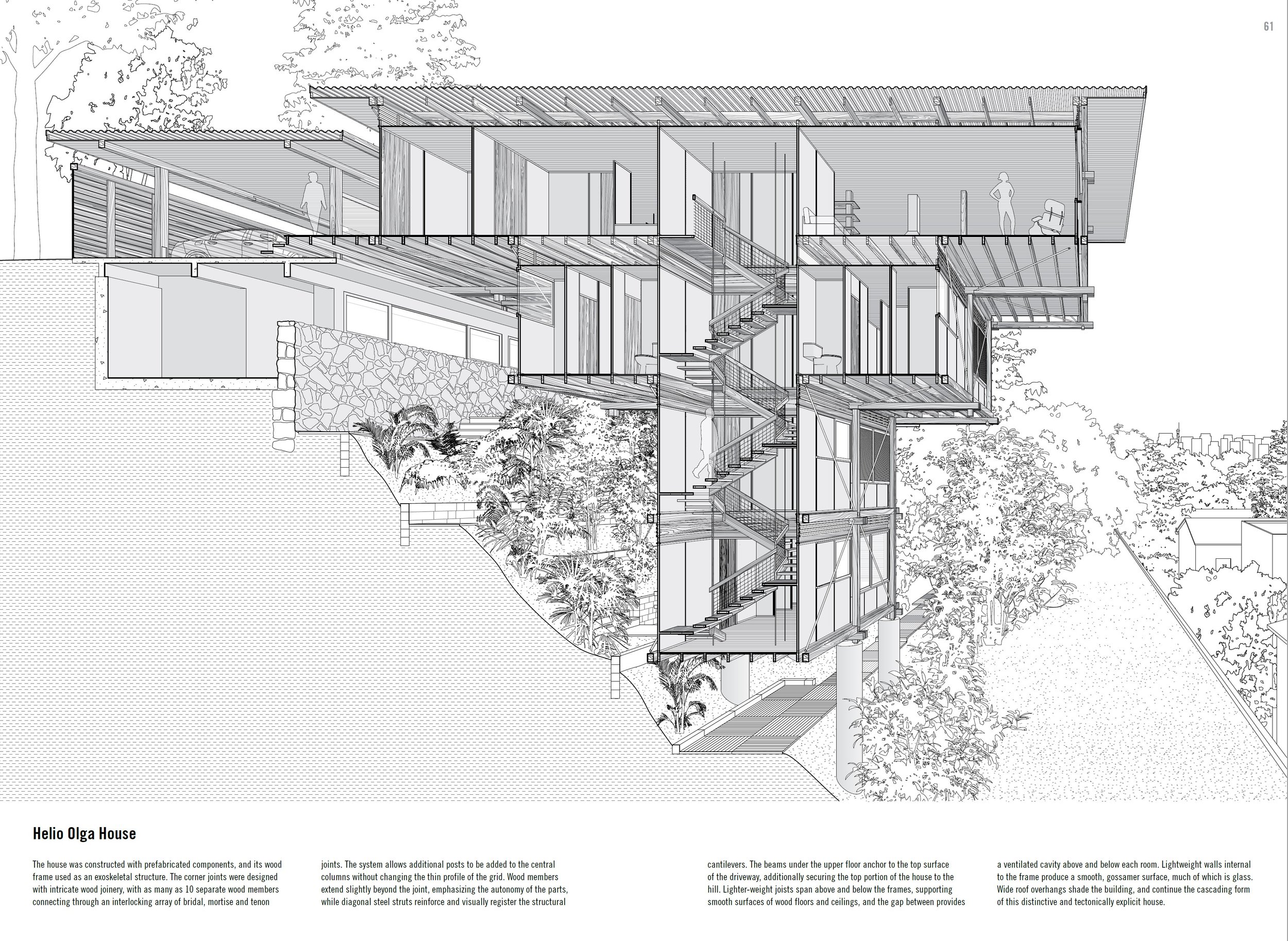

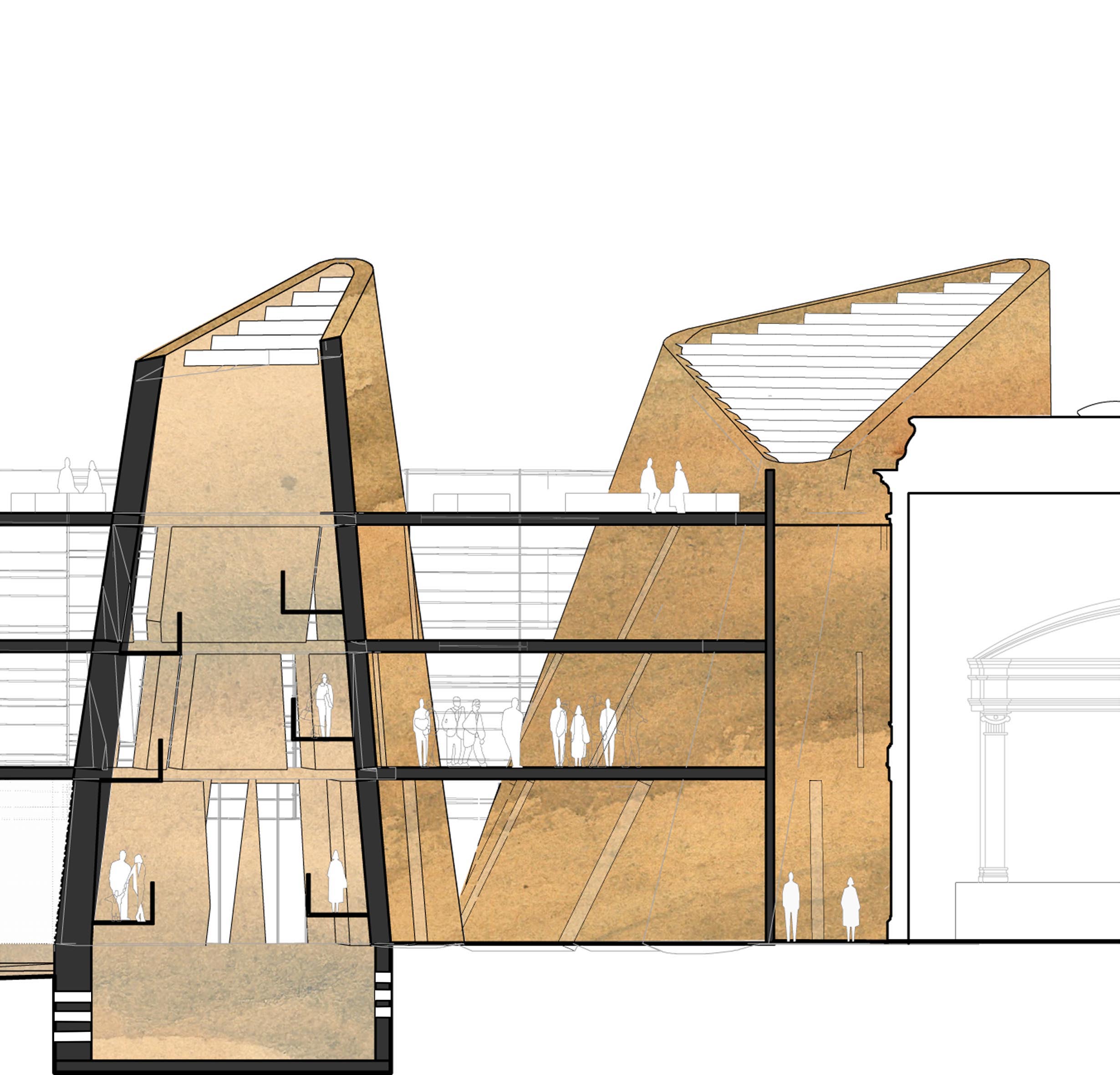

FRAME LTL Architects elevates new views on the overlooked technique

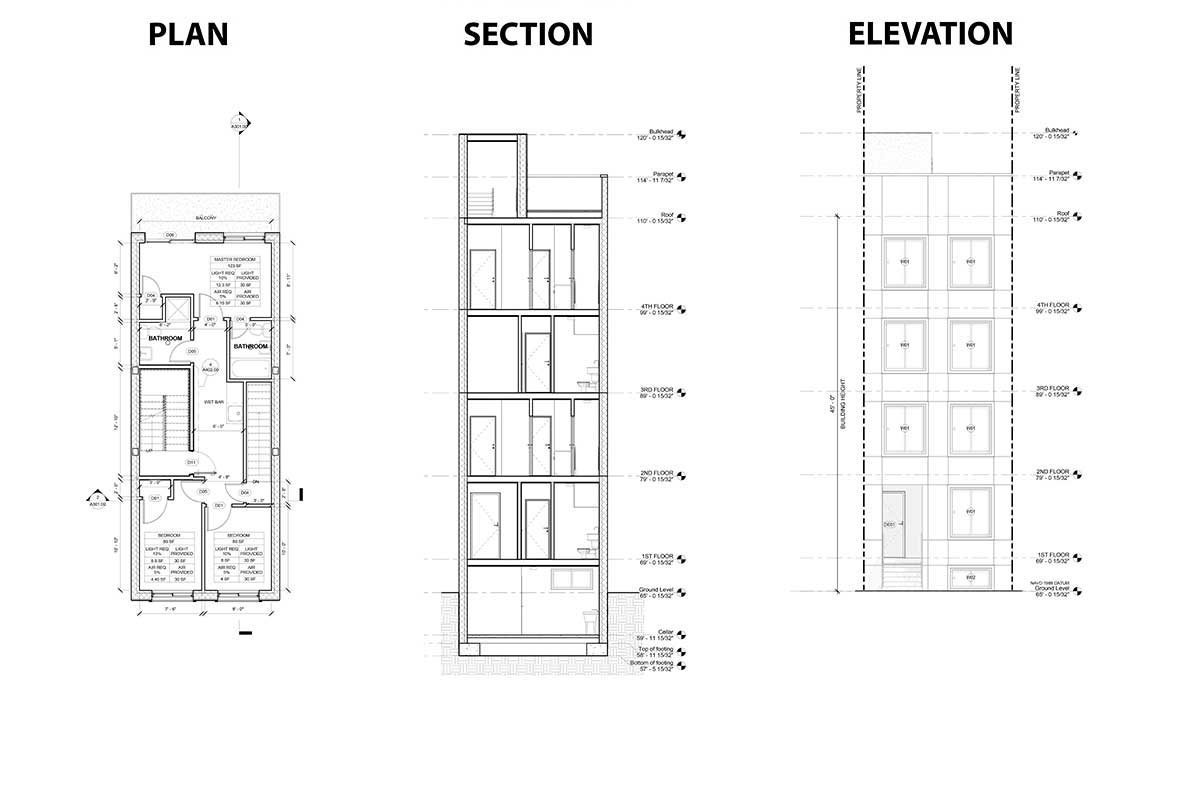

Plan Section Elevation Architectural Drawings Explained · Fontan

Episode 6: Creating Sections Quif Studio

Section PPT

Image Site Plan Working Drawing Examples Ayala Thencestraes

section definition Architecture Dictionary

Architectural Layout Plans And Drawings HN REPUBLIC ARCHITECTURE

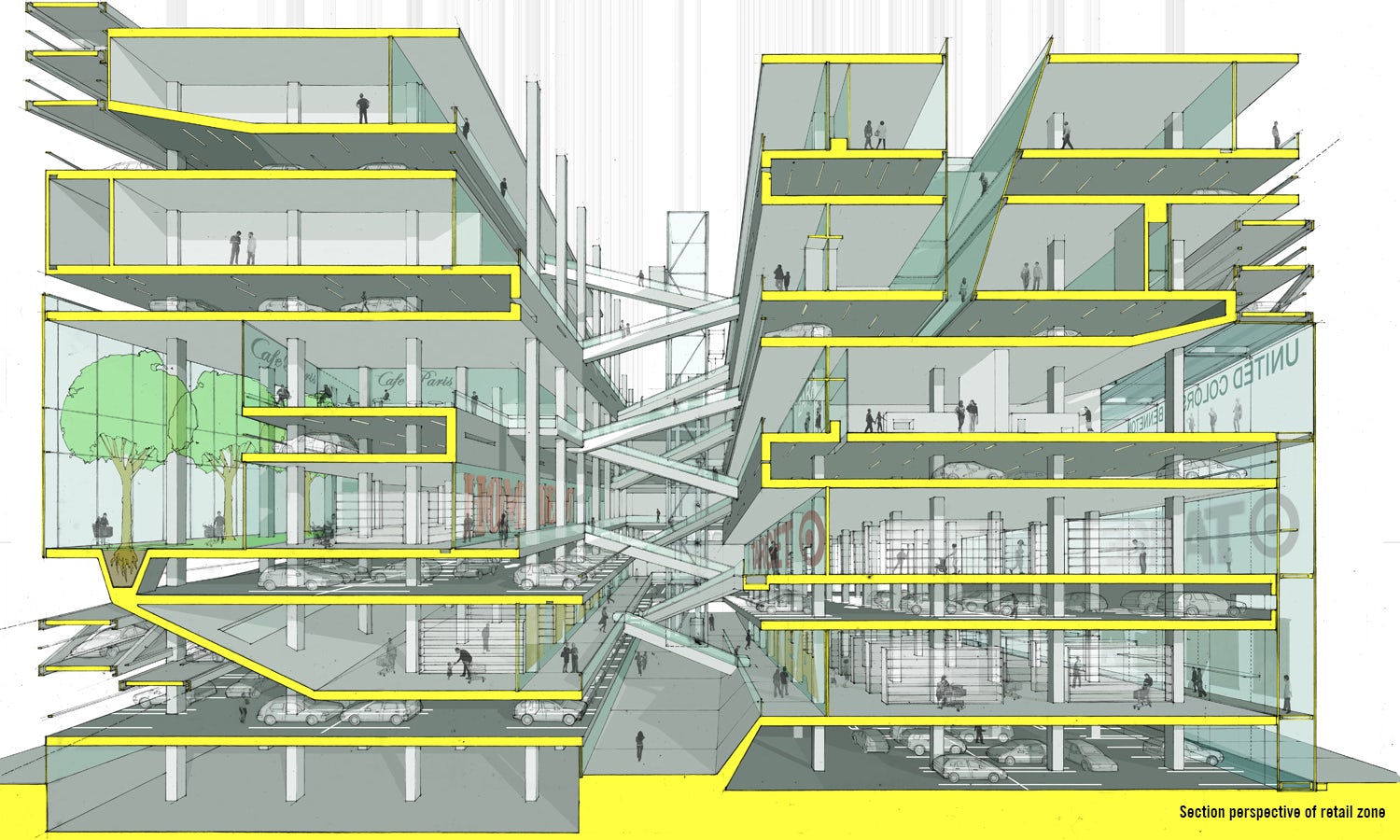

Flat Vector Detailed Perspective Section Creative Content Bundle Toffu Co

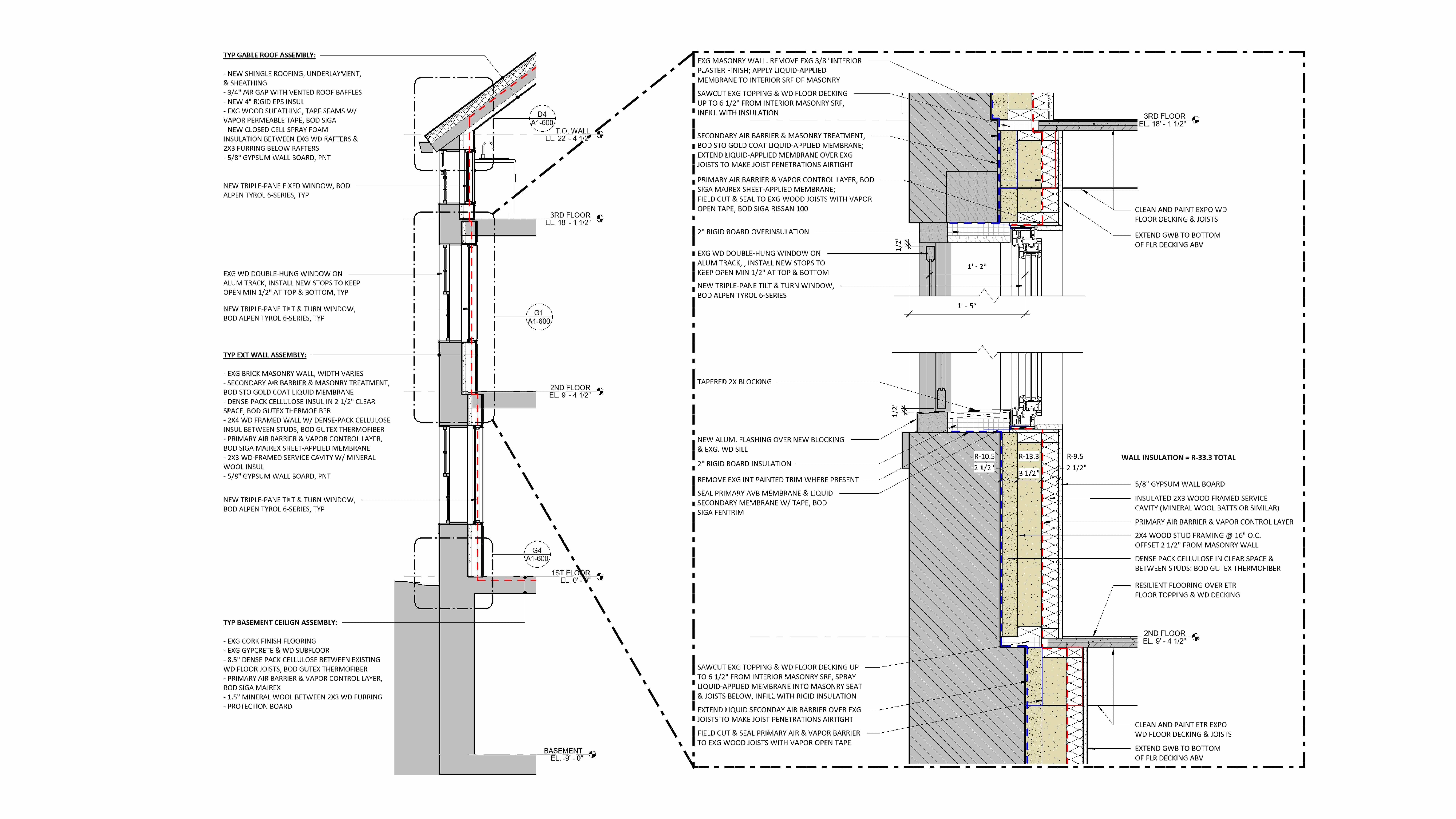

In practice: Jonathan Burlow on his cantilevered house projects

Manual of Biogenic House Sections LTL Architects

Section

Digital Media I Architecture presentation Architectural section

What Is A Cut Sheet In Architecture at Ryan Henderson blog

section Architect #39 s Journal

U L: Sections

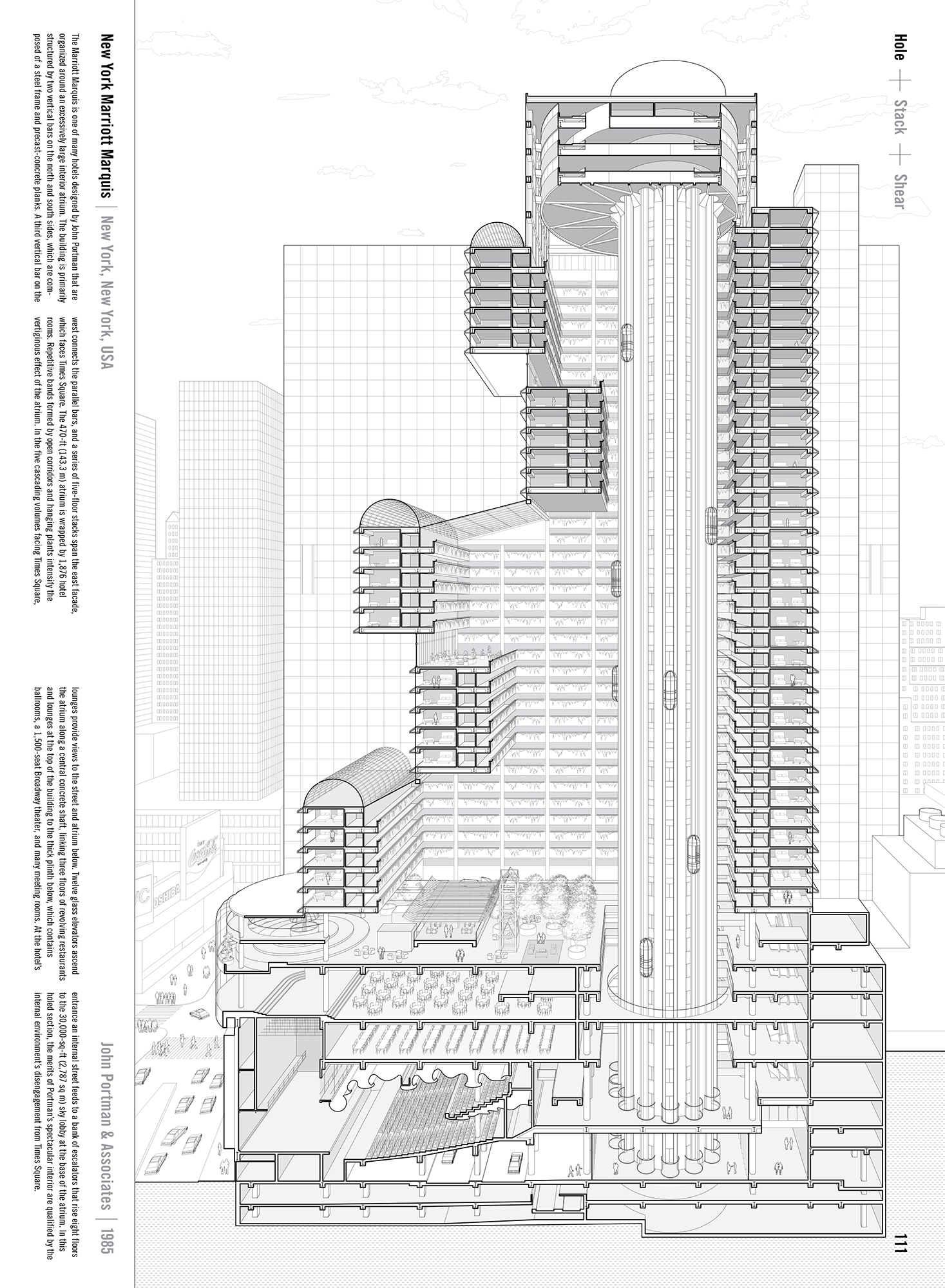

Manual of Section AIA New York

What does section mean?

Gallery of S HOUSE / Simple Projects Architecture 46

Gallery of Studying the quot Manual of Section quot : Architecture #39 s Most

Habitat #39 67 Planning and Architectural Drawings

.jpg?1372305515)

Galeria de Residência em Isfahan / Logical Process in Architectural

Definition Meaning of quot Section quot Picture Dictionary

Elevation Architecture

LSU landscape architecture section diagrams

How To Draw Sectional Perspective In Autocad

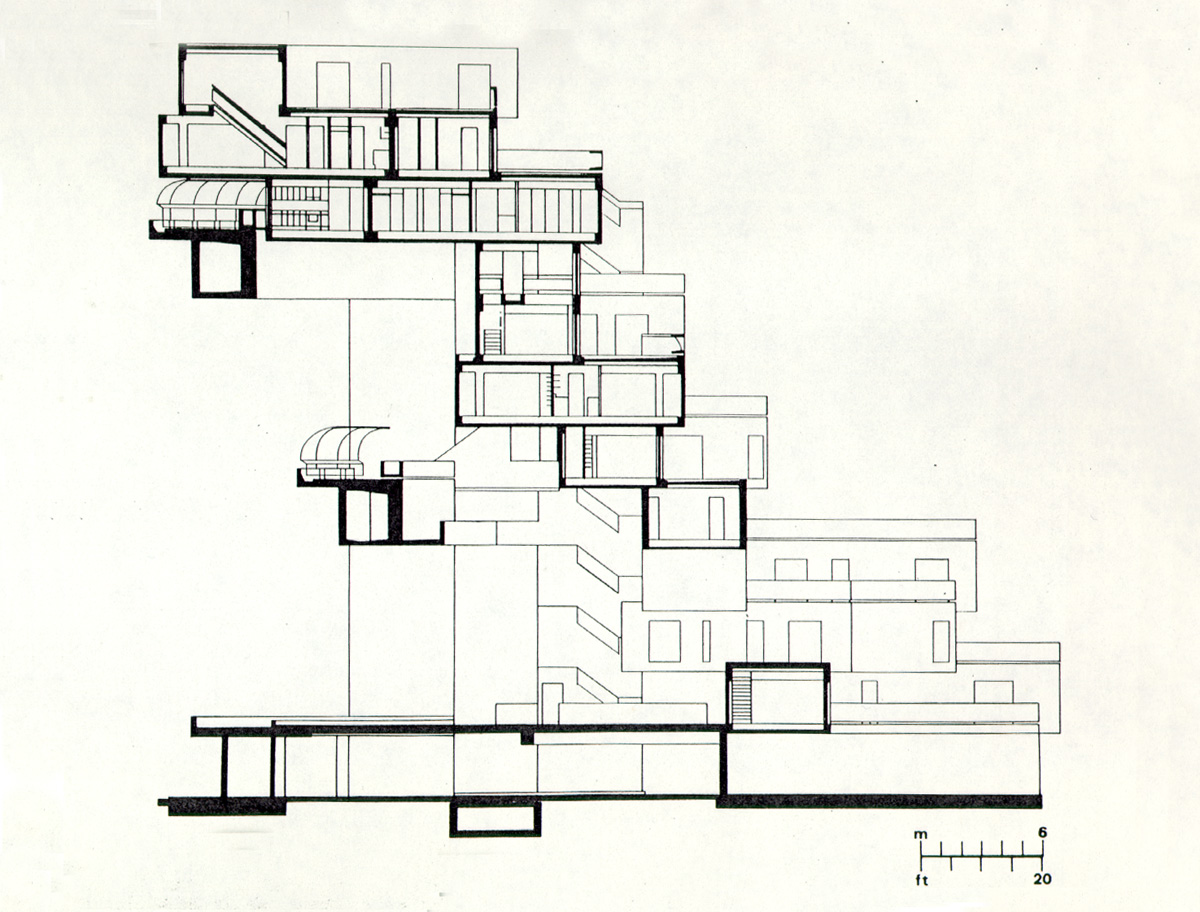

Paul Rudolph #39 s Perspective Sections

Architectural Perspective Section Architecture presentation

SECTION The Architects Diary

Section Elevation plan rendering in photoshop Upwork

Luigi Rosselli Architects Rammed Earth Library © Luigi Rosselli

Studying the quot Manual of Section quot : Architecture #39 s Most Intriguing

Architecture section drawings BibLus

Studying the quot Manual of Section quot : Architecture #39 s Most Intriguing

Sections