Qbi Calculation Worksheet

Here are some of the images for Qbi Calculation Worksheet that we found in our website database.

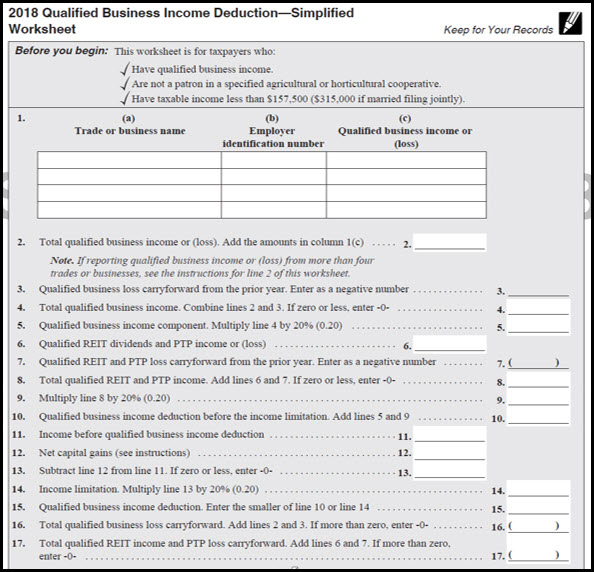

Qbi Calculation Worksheet Printable Word Searches

Qbi Calculation Worksheet Printable Word Searches

Qbi Calculation Worksheet Printable Word Searches

Qbi Calculation Worksheet Printable Word Searches

Qbi Calculation Worksheet Printable Word Searches

Qbi Worksheet 2023

Qbi Worksheet 2023

QBI Calculator 2024 2025

QBI Calculator 2024 2025

Quiz Worksheet Determining QBI Deductions Study com

Commercial Load Calculation Worksheet Fill Online Printable

Qbi Worksheet 2023

Qbi Phase Out 2024 Sellers Vintage brunofuga adv br

Qbi Deduction 2025 Robert N Arnott

Qbi Deduction 2025 Robert N Arnott

Qbi Worksheet Qbi Worksheet

Qualified Business Income Deduction QBI Calculator 2024 2025

IRS Form 8995 Walkthrough (QBI Deduction Simplified 57% OFF

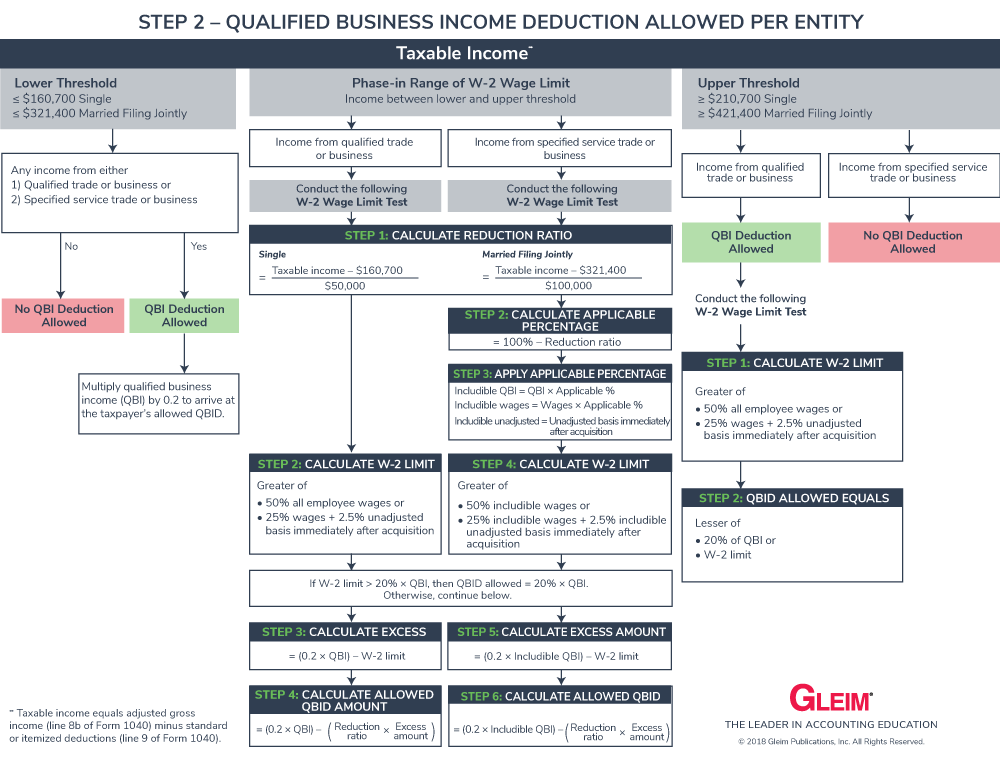

Qbi Limitations 2024 Berte Melonie

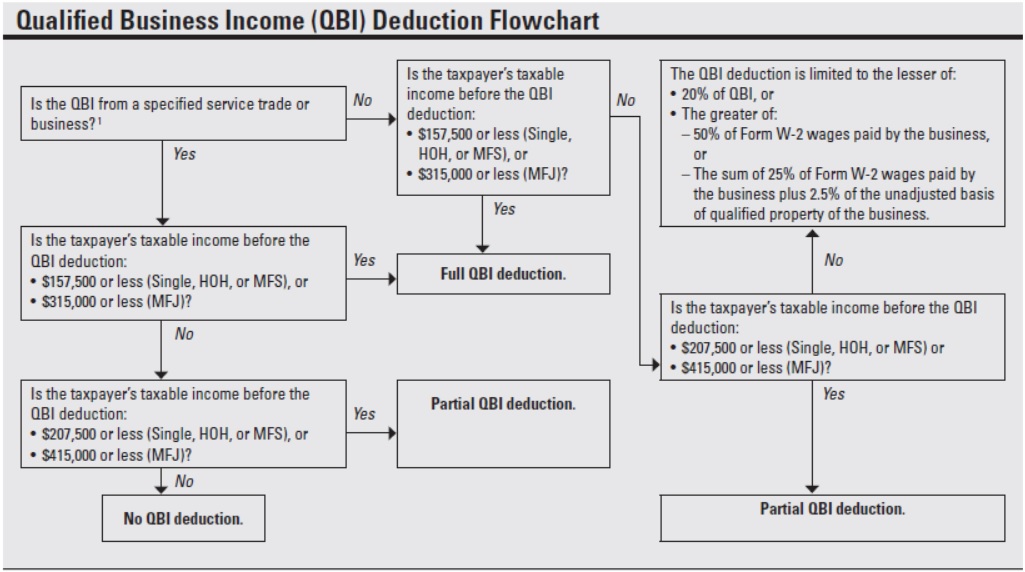

Qualified Business Income (QBI) Deduction

Qualified Business Income (QBI) Deduction

Qbi Deduction 2025 Kylie Minnnie

Qualified Business Income (QBI) Deduction

Fnma Income Calculation Worksheet Daily Routine Worksheet

Qbi Income Limitation 2025 Leesa Kalina

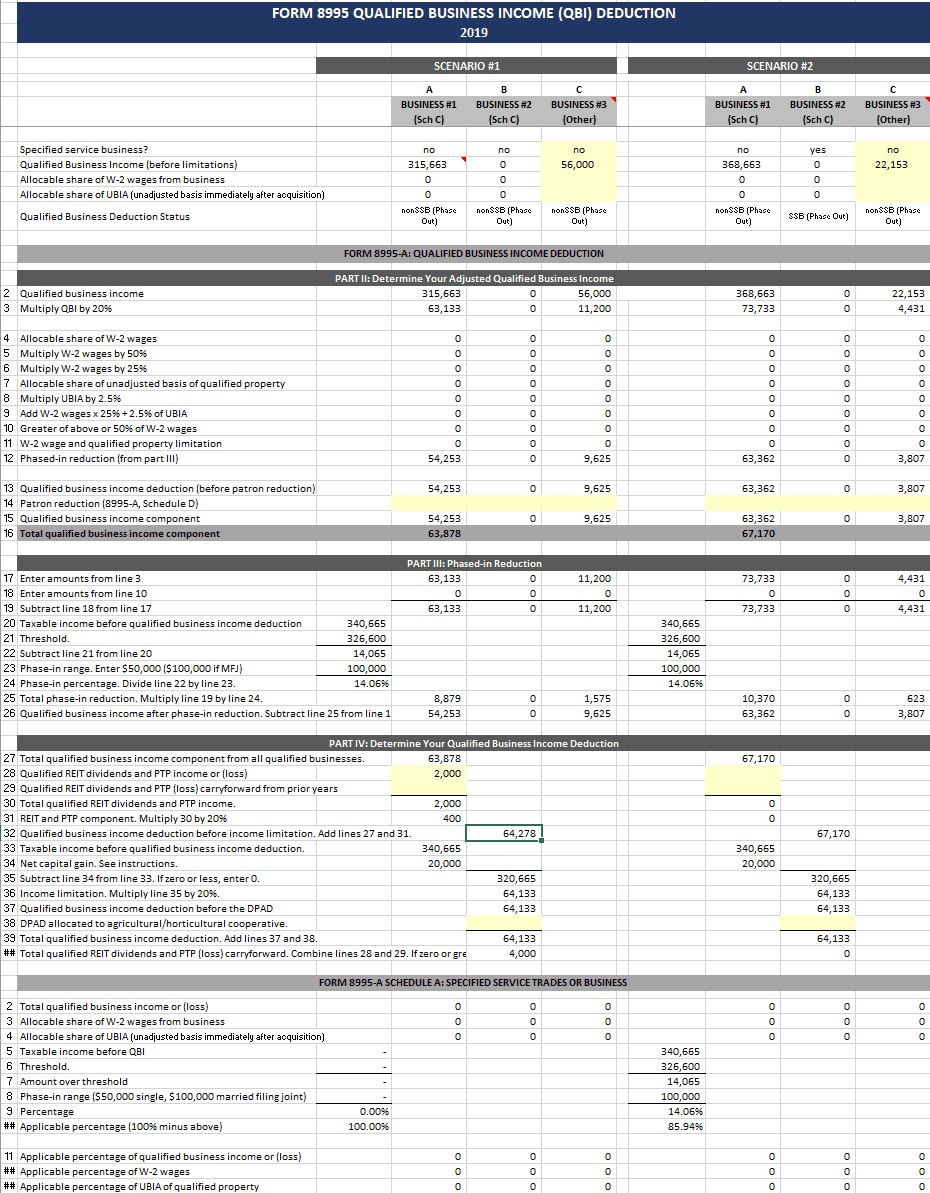

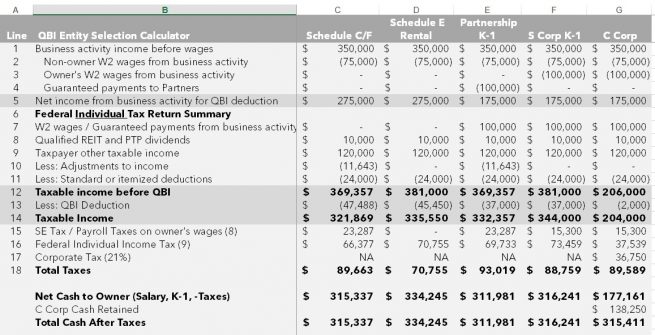

Schedule C Income Calculation Worksheet : New And Improved Intuit S Qbi

Schedule C Income Calculation Worksheet : New And Improved Intuit S Qbi

Schedule C Income Calculation Worksheet : New And Improved Intuit S Qbi

What Is Qbi Passive Op Loss At Rk

Do I Qualify for the Qualified Business Income (QBI) Deduction? Alloy

Do I Qualify for the Qualified Business Income (QBI) Deduction? Alloy

Solved: 199A special allocation for QBI Intuit Accountants Community

Tax Reform Qualified Business Income (QBI) Deduction Accountants

Income Tax Worksheet 2023

Section 199a Worksheet Instructions

ProConnect Tax Online Simplified Worksheet Section 199A Qualif

Demystifying Finance: How Do I Calculate the QBI Calculation? YouTube

(How to Calculate the 20% 199A QBI Deduction) Very Detailed (20%

Qualified Business Income Deduction Worksheets

New and Improved: Intuit #39 s QBI Entity Selection Calculator Tax Pro

active trade or business test irs

IRS Form 8995 Instructions Your Simplified QBI Deduction

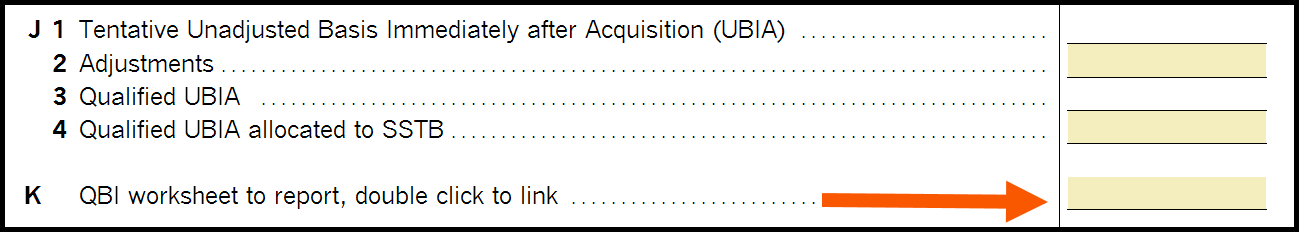

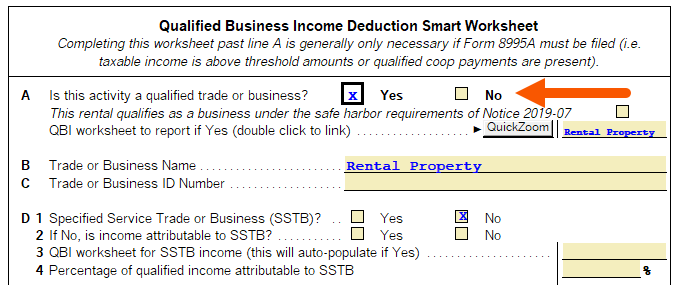

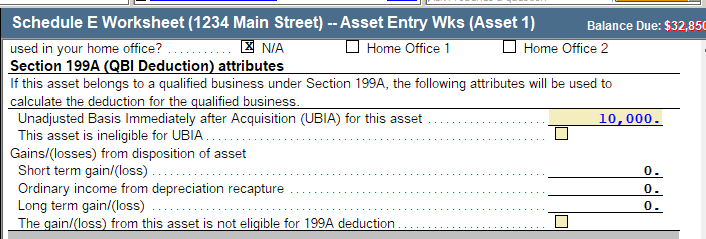

How to enter and calculate the qualified business income deduction

V VH and SK ppt download

How to enter and calculate the qualified business income deduction

QBI non SSTB Chapter 1 pp ppt download

QBI non SSTB Chapter 1 pp ppt download