Irs Method Vs Tax Court Method

Here are some of the images for Irs Method Vs Tax Court Method that we found in our website database.

IRS Logo symbol meaning history PNG brand

IRS Logo symbol meaning history PNG brand

IRS sang USD: INC Reward Service Giá bằng US Dollar CoinGecko

E File Provider Search Internal Revenue Service

IRS Careers

IRS转换为CNY:INC Reward Service在Chinese Yuan中的价格 CoinGecko

New 2024 Tax Brackets Vs 2024 Tax Brackets For Aile Lorene

SETCA

Irs Flaticons Lineal Color icon

Is The Irs Office Open Today 2025 Lib Pattie

Stanford Tax Adds AI to Automate Client Organizers for More Efficient

Trump Treasury confirms its eyeing IRS for #39 streamlining #39 shake up as

IRS Form 1040 NR Instructions Nonresident Alien Tax Return

What Is The IRS Full Form: IRS Meaning And Role Of IRS In Government

Irs Tax Forms 2025 Ashla Kristine

How Much Is Kroger Pension? Retire Gen Z

IRS Appointment

When Do Irs Open 2024 Joell Madalyn

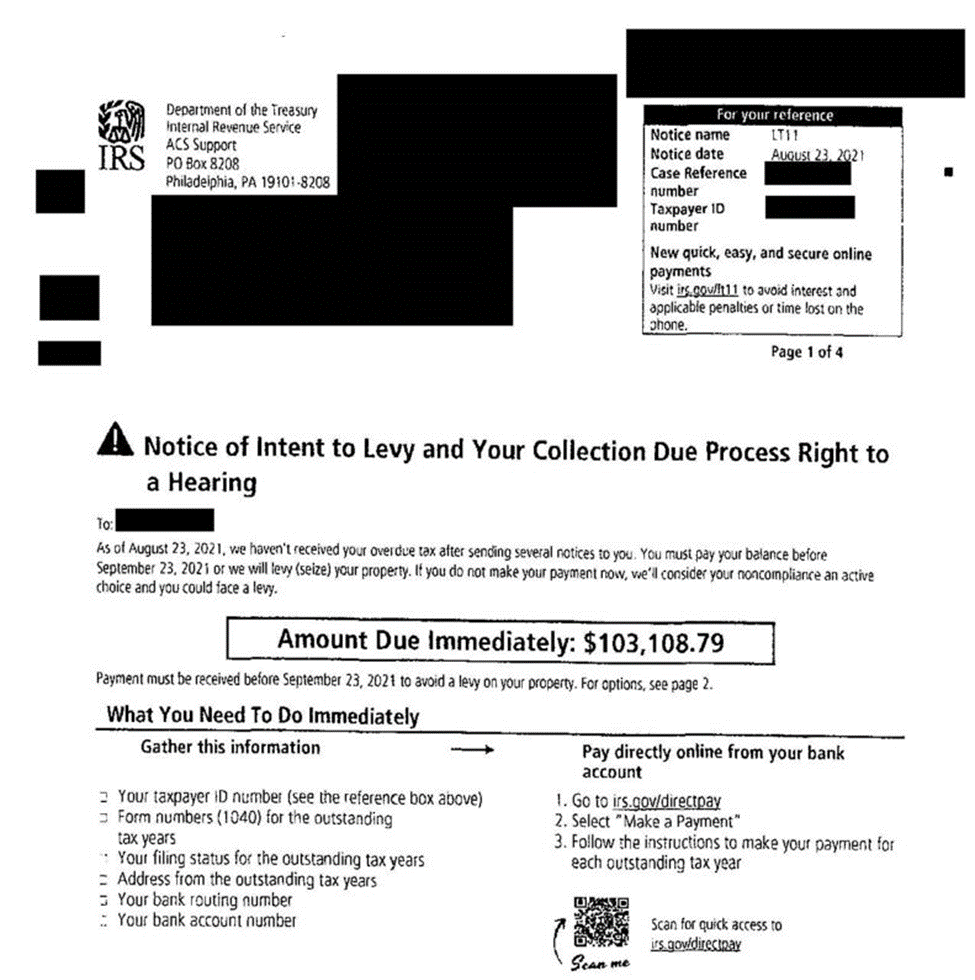

Sample Irs Letters

Are IRS Layoffs the Real Reason for Tax Refund Delays in 2025?

IRS Contact Phone Numbers How to Speak to a Live Person

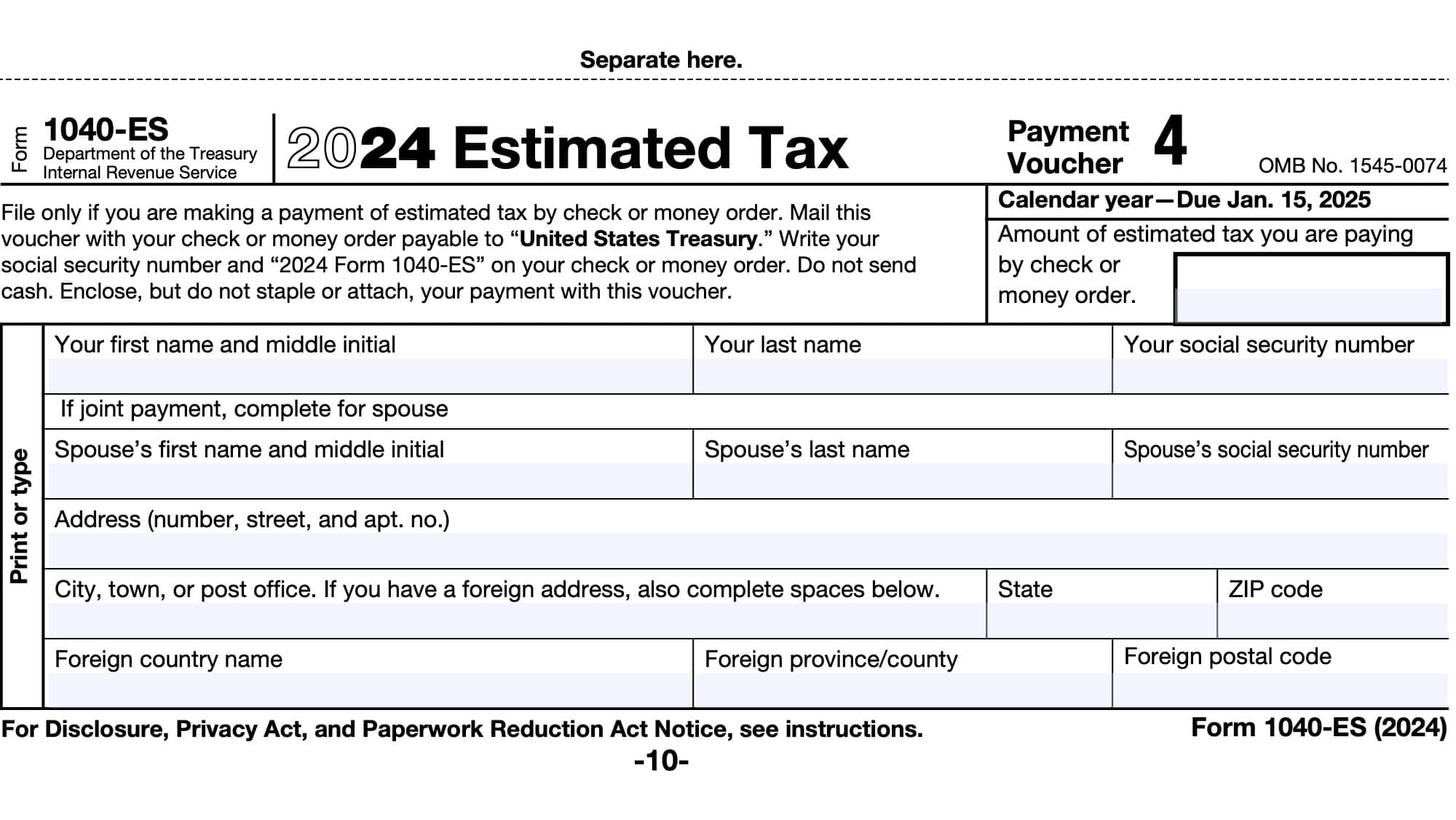

Estimated Tax Payments 2024 Safe Harbor Form Moll Sydney

IRS Form 433 F Instructions The Collection Information Statement

Tax Season 2024 Start Date Avril Georgiana

IRS Refund Schedule 2023 Delay Tax Return Update Calculator

When Is Form 941 Due 2025 Nathan A Robertson

Understanding and Filing Tax Form 2290: A Comprehensive Guide

IRS Form 8960 Instructions Guide to Net Investment Income Tax

2025 Standard Deduction Over 65 Single Heather Duncan

The IRS Just Announced 2023 Tax Changes

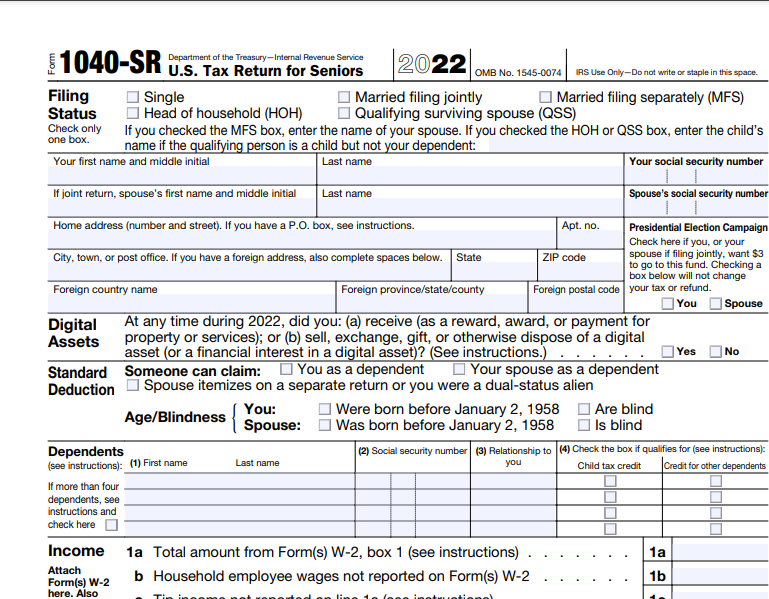

2024 Form 1040 Sr Elaina Stafani

$1400 Stimulus Check: Your Complete Guide

Tax Brackets For 2025 Income Limits Eugene D Booth

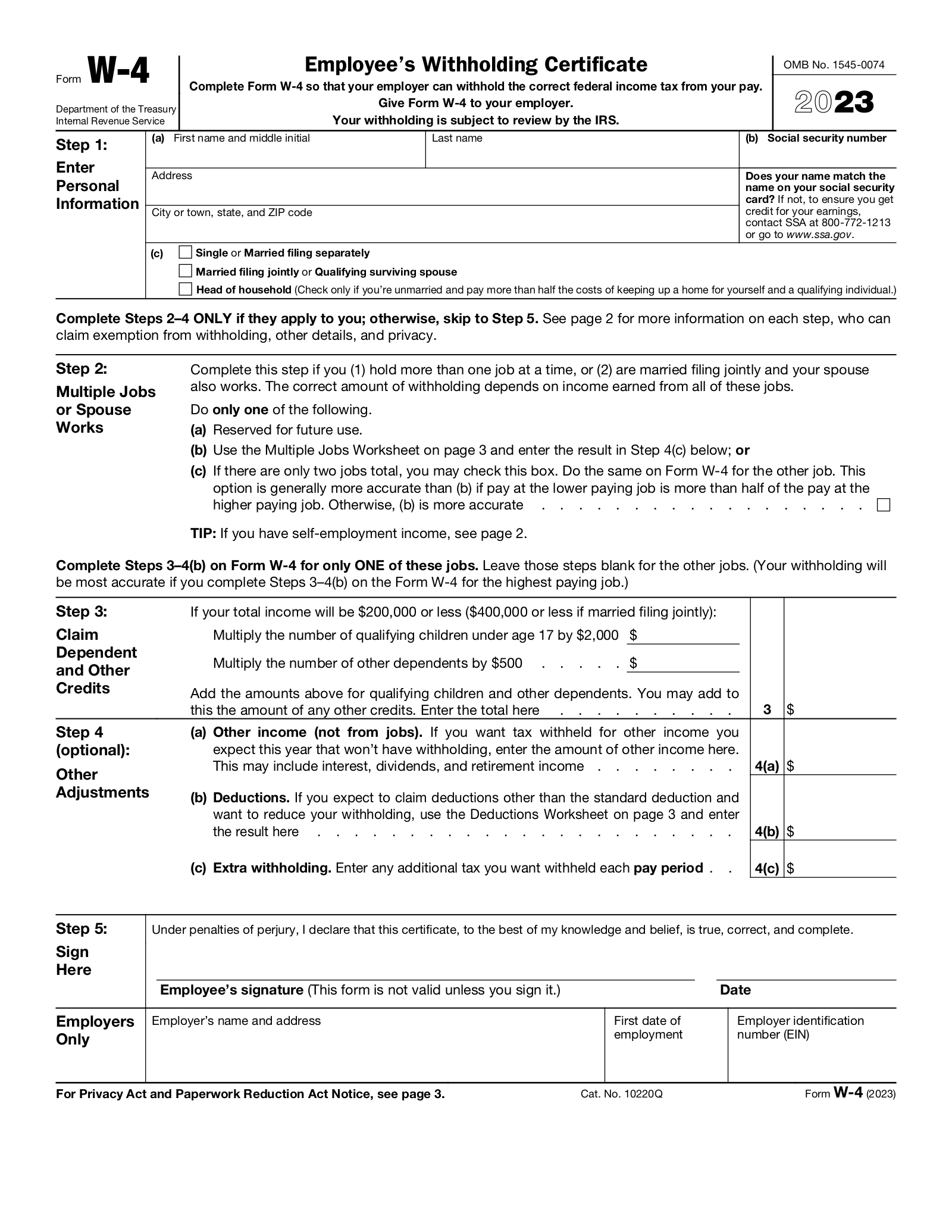

Tax Withholding Form W 4 2024 Printable Rania Catarina